How To Apply For A Auto Loan

How to apply for a auto loan - Dealers may ask you for proof of insurance before you purchase and take out a loan on. If you're looking to buy a car or truck to scale your business, it's important to know how this type of loan works, what you need to qualify and what happens if your business can't repay the debt.

How to Apply for a Car Loan While Serving in the Military

Apply online for a new or used car loan from capital one auto finance.

How to apply for a auto loan - Following these steps can help you find the right auto loan for your business: A business auto loan, also sometimes called a commercial auto loan, essentially works as an equipment loan for business owners looking to finance a vehicle purchase. It’s a great idea to have some notion of how much money you can spend before you head to the dealership and sit in a new, shiny car. How to apply for a auto loan

An auto loan preapproval is a tentative loan offer based on your financial and personal information. The application will request information about where you live and work, whether or not you. A photo id with your signature on it. How to apply for a auto loan

That’s why we typically provide auto loan decisions in 5 minutes or less. Government identification or a passport are typically acceptable documents. You can submit several preapproval applications to compare conditional offers from. How to apply for a auto loan

Mention auto loan agreement id or 20 digit auto loan account number along with the registered mobile number with the bank. There are a variety of things that you will need to provide to the bank when you apply for a bank auto loan. But you can take steps to help ensure you get. How to apply for a auto loan

View our navigate to bank of america auto loan eligibility requirements for information about minimum amounts financed, applicant eligibility and more. Get approved for a financing based on your needs and within your budget, with competitive lending rates. A car is a big investment and financing it can be a major cost. How to apply for a auto loan

We understand that when shopping for a car, you can’t always wait around for a decision. Preapproval isn’t a guarantee that you’ll get approved for the loan later, especially if your financial situation changes, but it can help guide your budget. The bpi auto loan step up payplan is purposefully designed to match your changing needs, especially during these times, so you can free up your funds and have allowance for rainy days. How to apply for a auto loan

Look carefully at what the lender wants for the loan application, and give them the details that will help you successfully apply for a used car financing deal. Check with your lender or dealership to see which they prefer. Ready to apply for a car loan? How to apply for a auto loan

This service is free of cost. How business auto loans work it takes some planning to find a business loan that’s both affordable and meets your operational needs. A score is considered fair or poor if it falls below 670 on the fico ® score ☉ range, which goes from 300 to 850. How to apply for a auto loan

As long as you have positive equity, you can apply for cashback auto loan refinancing. If you’re not currently enrolled in. The seller must be the same as the registered owner listed on the title. How to apply for a auto loan

Choose from over 2 million vehicles at select bank of america authorized dealers and apply for financing—all online. Simply enter your credit profile, monthly income, rent or mortgage payments, credit card and loan payments, and any garnishments. Steps to take before you apply for a car loan with bad credit credit scores are one of the factors lenders consider when deciding whether to approve a person for a car loan. How to apply for a auto loan

After submitting your application, you'll receive a text* or email letting you know the status of your application. Online banking customers may apply online for an auto loan to purchase a vehicle from a private party (an individual seller). The ideal situation is to wait two to three years after bankruptcy before getting an auto loan. How to apply for a auto loan

In that time you can get a secured credit card, use it for small purchases, and pay off the entire balance every month. This will show that you are making timely payments, on your credit report, and in turn will improve your credit. How to accelerate the financing process: How to apply for a auto loan

Car loan Car loans, Car brands, How to apply

Auto loan amounts are on the rise, and so are

Jaguar XE Apply For Auto Loan.(画像あり) ジャガー, 自動車

Apply now for a PSBank Auto Loan online to get Freebies

Auto Loan Application stock photo. Image of apply, deny

Apply for a car loan online with PSBank Car Deals

How to apply for a home loan Mortgage Broker Brisbane

How Do I Apply for a Car Loan? Dallas TX Principle

A Detailed Look At Astute Methods Of Apply For Car Loan

How to Increase Your Chances of Getting Approved for an

UnionBank Auto Loan How To Apply For UnionBank Auto Loan

Steps to Follow when Applying for Auto Loan VISA BANK TO

5 Steps to Take Before You Apply for an Auto Loan

Apply for car loan with bad credit

How to Apply for a Car Loan with Bad Credit Suburban

How to Apply for an Auto Refinancing Loan authorSTREAM

Apply For Multiple Auto Loans At Once Loan Walls

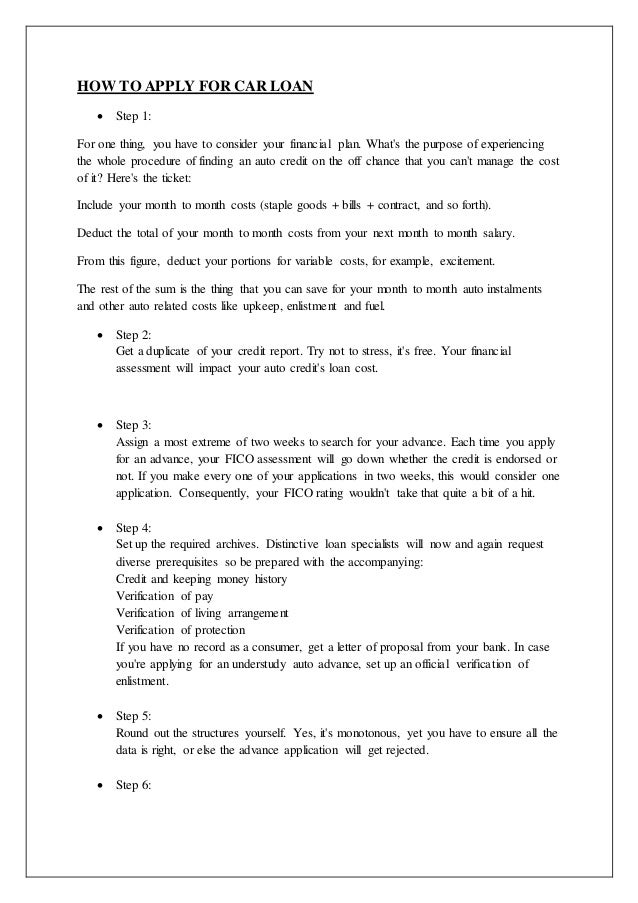

PPT How To Apply For Auto Loan PowerPoint Presentation